Table of Contents

Reviewed as one of the best peer-to-peer payment app, Cash App has eased out the way people used to make payments. It has stashed away the need to keep handy cash or cash cards altogether. The least it needs is an active internet connection and the payments are as easy as cutting a cake slice.

It is easy to make payments nowadays as compared to early ’90s. The reason these digital payments are recommended and legalized is that these have inspired paperless transactions and are thus bio-friendly. A lot of paperwork is reduced. The palpitating feeling of borrowing and owning someone’s money is no-more scarier as payments are superfast and easy.

Peer to peer payment apps allows customers to access their bank accounts with just pin access, without the hassles of actual login via user id and password. These apps ease out transactions, with lucrative discounts and cash back, such that an increasing number of people are willing to make use of these. The money that is sent or received via these payment applications, can be sent directly to customer’s bank account or can be left in P2P payment app wallet, which can be used in future for more transactions.

Standalone Services (PayPal and Venmo)

Such P2P vendors have their own mechanism (wallet feature) of dealing with money. They do not rely on banking institutions for transacting money.

Centered around Bank (Dwolla, Zelle, and Popmoney)

These are another kind of P2P vendors that involve bank while dealing with money. They facilitate the money transfer through its partner bank and credit unions.

Partnered with Social Media (Facebook Messenger, SnapCash, Google Wallet)

Social media applications integrated wallets just to ensure that their users stay hooked to their apps and can still make their payments. These apps can directly access their bank accounts with a small authentication along with OTP, but the greater hassle of remembering CVV in order to make payments via debit or credit cards is removed.

See Also: How Much Does It Cost to Develop a Mobile Wallet Application?

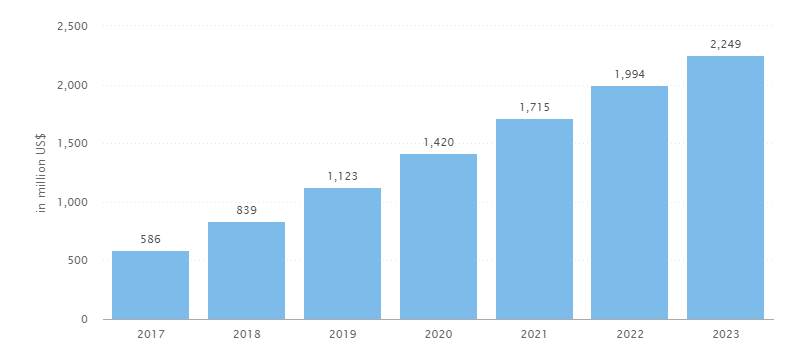

Image source: www.statista.com

Total Transaction Value in the P2P Money Transfers segment is estimated at US$1,123m in 2019

Cash app, alternately P2P payment app is a mobile payment service that provide for a safe, fast and easiest way to transfer money using a smartphone.

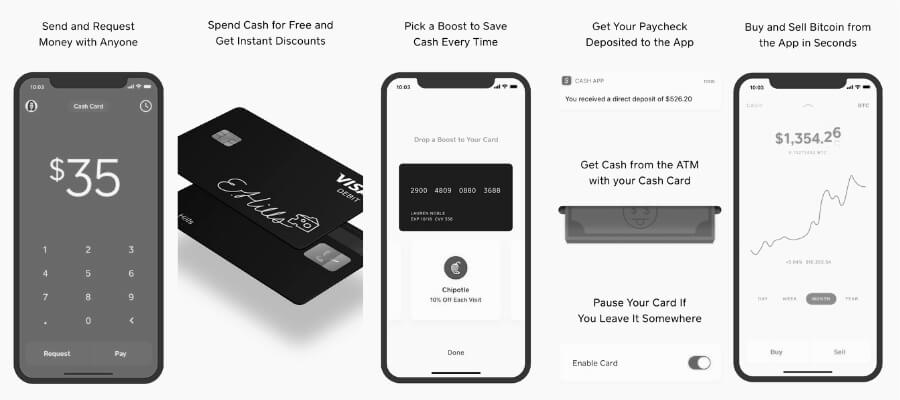

Square cash app is free to download and use – to send or request money. Apps like Square Cash earn by charging business transaction fees for using its software. The company charges 2.75% of the fees for every business transaction that is done via its application.

Square Cash app offers some expanded set of features to its individual customers, those who wish to use it beyond the free version already available.

The square cash application also charges 1.5% of the payment amount, to transfer the funds immediately (directly to the bank) instead of keeping the customers waiting for the standard number of days to reflect the amount into their accounts.

The rise in the usage of Peer to peer transactions has given the required freedom to users and have negated the necessity to add the beneficiary account before transacting. Plus, the users have the option to choose and select from the countless services. Some applications even provide free movie tickets or lucrative cashback upon completing the required number of transactions.

People make use of peer to peer payments apps for paying utility bills, recharge and bill payments, gifts and cashbacks, banking and insurance, healthcare, booking cabs and food orders etc.

One of the reasons for the increasing popularity of p2p payments apps is because these have reduced ATM visits. Users have got rid of the restriction of transferring large amounts amongst themselves without the interference of banks.

Apart from these, going hand in hand with upcoming techniques like cryptocurrencies is also a matter of choice and optional upgrade by these Fintech apps. To know more, explore our previous use case on P2P payment options. Consult our experts for P2P app development services.

Neeti Kotia is a technology journalist who seeks to analyze the advancements and developments in technology that affect our everyday lives. Her articles primarily focus upon the business, social, cultural, and entertainment side of the technology sector.

Or send us an email at: [email protected]