With the growth of technologies and allied facilities and resources that have enabled significant transformation and sparked digital revolution connecting almost every gadget or equipment we use with internet, IoT has grown manifold over the last few years. Analysts at Gartner anticipate there will be 25 billion cell phones, smartwatches, wearables, associated automobiles and other connected gadgets by 2020.

If you look into the possibilities and prospects that IoT offers to the world of banking, there are many. And it goes on to get bigger as you anticipate needs to solve problems, improve efficiency and empower processes.

Embedded sensors, gadgets, wearables, equipment, IP locations, all are being implemented and offered in combination with internet to offer you incredible IoT value.

IoT is certainly the next big thing that companies and governments are moving towards and is as big as the invention of internet itself. And when we compare its impact and influence on the traditional and modern industries its almost equally eminent. The segments that deal directly with end-users and need to serve them through integrated systems and with dynamic communication interfaces need to be dealt with and powered by advanced systems and committed resources. And IoT, by the virtue of its existence plays a crucial role as it has to work with systems that involve high risk and strut reporting networks that have to carry and process sensitive information.

Banking and Finance industry for that matter, is the most related and the most benefited one. And that’s not just looking from the perspective of mobile banking but also from the front of retail banking. The domain is exploring and bringing in a lot of resources and practices to promote their approaches to match with the IoT technology.

With time, we are going to see a lot of IoT innovation coming in to the banking domain and enriching it with secure networks, robust methods, improved protocols, advanced data mining, participatory sensing, better GIS system and higher quality of services.

IoT can be not just helpful in optimizing processes and empowering user-interaction but it can play a predominant role in inducting innovation-driven techniques and help banks in refining and enriching their tasks and practices to advanced levels of quality and proof.

In the current global scenario, we are seeing a lot of banks and financial bodies coming up with policies and plans to enter into the fold of digitization, implementing IoT in their workstream. In this attempt a number of banks have already adopted a perceptible plan to enter the process of optimally utilizing the ranging IoT benefits. The resources and techniques banks implement in different processes and tasks are introduced to the extensive scope and inventive choices that IoT has to offer with its inductive thought machinery and resourceful value mechanism.

For the banking sector, there are various chances to benefit by the IoT, with $2 trillion of monetary advantage anticipated at a global extent by Gartner.

The most persuasive part of the idea is that consumers are growing in their habits and their choices have evolved towards digital technology. Most of the Urban Bank Customers today have a smartphone and they are savvy with different modes of digital transactions. Among many examples and stats that underscore these facts, there’s a BI Intelligence survey on US Banked Millennials that further emphasize the needs and preferences people have today with banking.

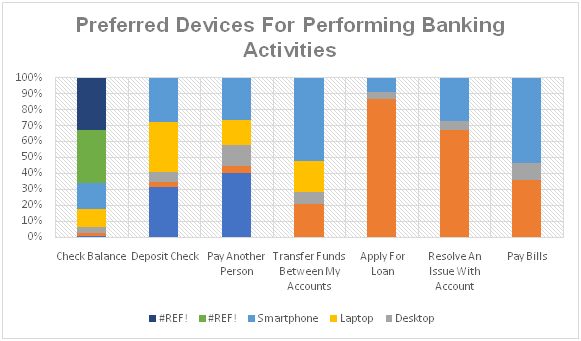

Even when you look into the figures on preferred devices for performing different banking activities, you find how users are increasingly relying on the IoT technology in different aspects of banking. And most of these, for the matter of fact, are related to the most frequent and most crucial banking operations and practices. Here’s a comparison graph showing how this idea goes with millennials in the US.

US banked millennials who use a device(s) for banking,

Source: BI Intelligence Digital Banking Survey, Q3 2015

If we look into the figures, we have derivative references, market surveys and factual data supporting the fact that the industry is fast penetrating into the digital arena with technology-driven resources and tools. If we specifically talk about IoT, banks worldwide are using it to augment and drive various processes and functions that make them commit to smooth functioning and quality results – addressing evolved customer needs, serving them with proficient role, inventive traits and immersive capacities at all levels.

The increased use of smartphones and hand-held devices by customers has amplified the use of IoT data. Which in turn makes IoT transform lives and change the way businesses operate. Today, everything is connected, wireless, or being wired up. Banks are converting IoT data into useful and valuable information, thus being able to increase their market stake and provide better services to their customers.

In a study on the growing mobile technology a section describes the impact of IoT to be growing aggressively in the banking sector. The vital figures include the fact that 64.5 % of worldwide banking officials monitored their clients through portable applications on smartphones, tablets and other advanced gadgets. The same study also states that a huge chunk of banks’ IoT budget (32% in2015 and 29% by 2020) will account for monitoring financial services and products. Additionally, by the next year the corporate bankers would plan to allocate about 30% in their IoT budget to track customers. This allocation is predicted to boom to 34% in 2020. The most crucial BPR improvement is related to tailoring their services and products.

Moving further, NFC (Near Field Communication) should be vastly implemented at Point-of-Sales and will be covering a large part of transactions and would be braced by banking resources and practices. Banks could come with centralized identity scanners and KYC booths that should work in a BYOD setting, which would be all controlled and operated by a centralized IoT governance.

With time, as the technology would take more dependable shape and settle to offer a comprehensive output within a pro-operational regime, it would be worked upon to deliver more in terms of data privacy, interoperability, traction, information sharing, and security.

Some of the IoT gadgets and supplies that would revolutionize the banking industry include Core Banking Apps On Your Smartphone, Touchid-Enabled Sensors, Smart Calculators, Personal Banking Pods, Security Keys & Card Readers, Digital Assistance, Contactless Payment Desks, Finance Tracking Apps.

Another idea that signifies the growth of the banking economy through technology is the growth of digitized banking panels and automated functional modules that require device connectivity and equipment support to operate. And we have seen the evolution and growth of ATMs and Interactive Tellers with advanced interactive and security options.

Banking industry is not new to the concept of IoT as the ATMs we already use for years are one of the earliest IoT technologies we have around.Though in the modern times to keep them meeting growing needs they have been taken through series of technical upgradations, resource validation, interface refinements, and security enhancements.

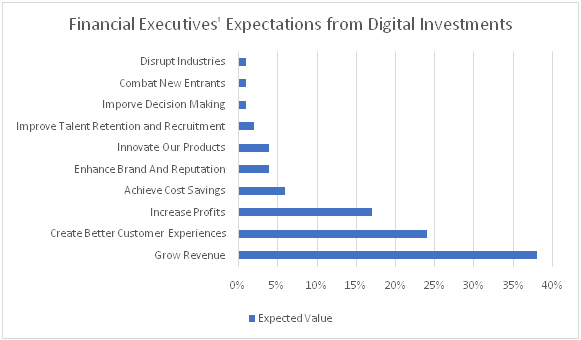

If we connect this growth with other aspects, this is certainly going to accentuate the user experience and the value that is created through banking services. And here’s the data showing the value banks expect from digital enterprise investment.

Source: PwC Digital IQ, 2015

IoT helps banks to extensively utilize and patronize the significance of data and analytics. Taking a generic household scenario, your refrigerator senses the shortage of milk and intimates the neighborhood supermarket and requests a certain quantity settling the payment on its own and in a completely automated manner. You can visualize to what extent IoT can help banks deliver value to its customers. It will help you in managing different operations with great level of superiority and proficiency. And this will be not just about handling and executing different tasks and affairs of banking, but it would commit to great details and logics to make your everyday chores and important tasks a matter of sweeping and easy interfacing with the IoT banking.

IoT will help every part of the industry ranging from Consumer Banking, Corporate Banking, SME Banking to the Insurance sector and will be suppling highly absorbing resources and possibilities – allying with factors and supporting ideas of the new-age banking.

You can think of anything from screening a profile’s eligibility and realizing best accounting goals to venturing into new upgraded online banking modules and customer service interfaces. This can range anywhere from allowing the customers to do contactless payments to empowering the processes by creating personalized service components based on user matrix and allowing sensor-based updating of records.

Most importantly, IoT is going to help small businesses and local traders to have access to better technology that allows them highly organized, consistent and fast services, that are otherwise a distant thought for them.

In a nutshell, IoT is going to help banks in not just automating their processes and enriching their communication but instigating and empowering them to capture, accumulate, process, and read massive amounts of records for market penetration and in making vital decisions related to technologies, enriching the overall functioning and upkeep of banks. At the same time,with IoT there would be equal help in maintaining privacy and data security which would further translate into sound practices and great services at all levels.

At Konstant Infosolutions, we aim at delivering valuable information on various technology topics, allowing you to have the benefits from our expert research and insights to help you in business. If you would like to know anything on the topic or about our services you can email us at [email protected].

A marketing graduate, a deemed strategist, a sure geek - Tushar is a fine blender of the art and science of writing. When it comes to tune up content with commerce, he knows the trick. For him, if words don’t make you think and beat, they are not worth your time. A crazy foodie, an unfailing jogger – that’s him off the desk!

Or send us an email at: [email protected]