According to a recent Statista report, eCommerce sales will reach $4.32 trillion in 2025. The online payment system has contributed to elevating e-commerce sales to achieve the trillion-dollar mark.

Therefore, it’s high time for businesses to adopt the right payment gateways. These online payment gateways can help improve customer experience, increase profits, establish a strong brand persona, and improve ROI.

In this article, we will talk about payment gateway integration in business websites and mobile apps.

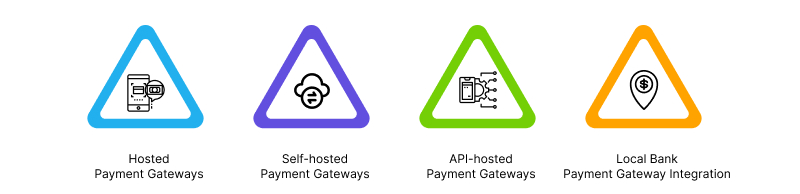

Businesses rely on third-party services for hosted payment gateways. For example, Square payment gateway integration allows website owners to build a custom payment solution. They are easy to integrate and offer robust security.

You can choose the self-hosted payment gateway to give your target audience a personalized shopping experience. These gateways can offer a great user experience and a unique checkout process. If you are ready to adopt self-hosted payment gateways, you must comply with the data protection standards, including PCI DSS, AML, and GDPR.

API-hosted payment gateways are feasible for businesses with a simple checkout system. Companies can collect payment information using APIs and provide a great customer experience. However, they must have secure cardholder data to meet data protection standards.

Businesses can leverage the bank’s payment server and integrate their payment gateways directly. Bank integration is helpful when payment companies are active in a specific region or locality. However, the quality of payment services is not guaranteed; business service quality depends on the bank’s current technologies and support level.

Payment gateways take merely a few seconds to complete the online transaction process, despite having a high transaction volume.

Businesses can harness numerous benefits by integrating payment gateways into their fintech apps, such as

Note that all the benefits exist, and the payment gateway industry still faces many challenges. You must overcome these challenges to choose and create a valuable payment gateway system.

Discover the challenges companies encounter when integrating payment gateways into their website or mobile apps.

Hence, businesses must choose the payment gateway model to ensure long-term profitability.

Here is what you need to consider while choosing the appropriate payment gateway.

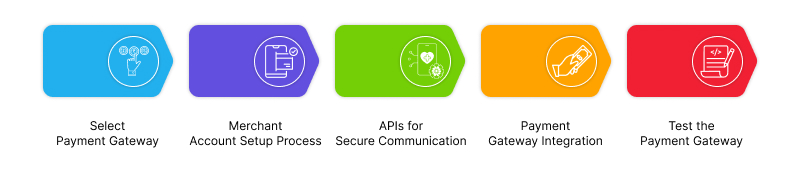

Read the steps below for a successful payment gateway integration to your eCommerce or fintech website.

eCommerce payment gateways are in high demand as the popularity of digital payments rises. Research for the payment gateway model that fits your business goals and offers scalability. As a fintech app owner, you must consider the transaction fee and cross-border fee if you are open to international payment gateways, compatibility, and security protocols.

Next, set up a merchant account on the platform for online payment gateway integration. For Stripe and PayPal payment gateway integration, you can easily set up the merchant account following their in-app instructions and support.

Once the merchant account setup process is complete, you will need the APIs for secure and seamless communication. The platform-compatible APIs allow interaction between the business website and the payment gateway’s server.

There are two ways to integrate payment gateways:

Therefore, the best course of action depends on your business model and operations.

Use the sandbox testing method to evaluate your payment gateway app’s performance. Once the payment gateway system meets market standards, you can go live.

Further, you must update the payment gateway solution regularly for robust security and high performance.

The popularity of mobile transactions, contactless payments, and instant payments has been rising after the pandemic. In the United States alone, people use smartphones to pay for everything.

Further, Apple Pay and Google Pay get prioritized for digital payments in the USA. People also prioritize PayPal and Google Wallet over credit/debit cards to pay in a few clicks.

Are you intrigued by how to integrate a payment gateway into your mobile app?

Let’s dive deeper into it.

Follow your business needs during the eCommerce payment gateway integration process. Know which type of business model you offer.

The answer to these questions can help you decide on the right payment processing model. Your e-commerce business analytics also guides you in understanding your customers’ payment preferences. You can add options, including debit/credit cards, bank transfers, and marketing payment offers.

When you are serving global clients, choose the right payment gateway solution. The decision should also include country-wise popular payment options. You will have two primary benefits:

Hence, choose the payment gateway providers that support most currencies, offer lower foreign exchange conversion rates, and have reduced cross-border fees.

Foreign regulation compliance makes the payment gateway integration process and operation a smooth ride. You must

The legal formalities are necessary for smooth customer onboarding, improved user experience, and establishing credibility.

A custom mobile app development company must implement all the security measures to build a secure payment gateway solution. It includes:

Well-planned payment gateway security measures ensure smooth payment processing and improve ROI.

Payment gateway developers use the sandbox method for standard testing. Sandbox testing is an integral part of payment gateway integration services. Developers test fintech applications, files, or code to analyze their behavior.

These tests in a virtual environment help developers understand the app’s efficiency, stability, and effectiveness in the real environment. Once tests are complete, it’s time to deploy the payment gateway API to the client site. Once deployed, monitor it regularly after it goes live.

Once the payment gateway system is operational, developers continuously monitor performance. They upgrade the system based on user feedback, glitches, or new technological advancements.

Expanding the payment gateway solution to a new market is not easy. You must comply with new protocols, strategize marketing campaigns, and provide facilities according to users’ needs. So, you can deliver a seamless mobile payment gateway integration solution.

Also read: Build Your Own P2P Payment App like Cash App in 2025

Konstant Infosolutions has been a trusted partner that offers result-driven payment gateway integration services to its global clients. The company can help you optimize iOS and Android payment integration, such as Apple Pay using Stripe. They give access to a talented team of project managers, developers, designers, and analysts.

Besides Stripe, we offer diverse fintech solutions, including Square and PayPal payment gateway integration, to help businesses handle an influx of customers. Their team will also help you with WooCommerce, BigCommerce, and Shopify payment gateway integration services. This fintech app development company provides solutions tailored to your needs and ensures that success knocks on your door.

Also read: Stripe vs Braintree: Which Payment Gateway Is the Best for Your Business?

In this digital world, customers prefer digital transactions over cash payments. Therefore, choosing the right payment gateway is essential for businesses. Whether you belong to the finance, real estate, eCommerce, beauty, fashion, or manufacturing industry, a smooth payment system is necessary to make sales online.

You can offer customers integrity, a secure network to process payments, appealing deals, user-friendliness, and more. If you have decided to build a custom payment gateway, you can overcome all the restrictions that commercial payment gateways offer.

You can find a trusted payment gateway integration company and build an efficient, modern payment solution. Let’s not forget that new technologies like AI, ML, blockchain, cloud computing, big data, and AR/VR are soaring. They could help you build your dream payment gateway solution.

For more information, contact our experts now and get a free consultation.

Top payment gateways in the USA are Stripe, PayPal, Amazon Pay, Skrill, Payza, Net, Razorpay, Paytm, PayU, and Braintree.

These are four ways to ensure security in payment gateways:

The cost of integrating a payment gateway into your website or mobile app depends on development complexity, gateway type, and fee structure. Usually, the payment integration company charges between $25,000 and $100,000 to complete the project.

Security is the biggest challenge a website development company faces during payment gateway integration. Businesses must adhere to the reformed security laws in particular regions and update their terms and conditions.

Vipin Jain is the Co-Founder and CEO at Konstant Infosolutions and is in charge of marketing, project management, administration and R&D at the company. With his marketing background, Vipin Jain has developed and honed the company’s vision, corporate structure & initiatives and its goals, and brought the company into the current era of success.

Or send us an email at: [email protected]