Call it “Cash Advance Apps or Payday Advance Apps”; these are heavily trending in the marketplace. Almost every earning and even the non-earning person is aware of such apps; because these apps are their whole & sole way to lend money in their urgently required situation immediately. Talking about the popularity of these instant money-lending apps; Dave comes at the top.

Do you know that Dave Inc. has a market capital of 72.67M, and still the numerics are increasing? Even other apps like Dave are also increasing their worth in the marketplace day by day. So if someone wants to start earning more profits with such app creation, they can opt for building an app like Dave.

Don’t worry, we got your back. In this blog, we will discuss ‘How to Develop an App Like Dave – A Complete Guide’. You will come across different aspects; such as what are the cash advance apps, their features, how to develop them, cost and duration to build alternatives, etc. So let’s get started with the discussion.

Before we continue with other details about cash advance apps and Dave, it is important to know what these apps are. Cash Advance Apps are kinda of short-term loans. The users can opt for fun more easily and quickly compared to traditional loans. The duration to receive money might take a few minutes or a few days, entirely depending upon the service provider. These mobile applications are quite similar to eWallet and other loan lending apps. The Cash Advance Applications allow users to connect with service providers and lenders to avail money in no time.

Cash Advance Apps like Dave are dedicated to helping working professionals, who need funds immediately before their next paycheck arrives. When you use Dave or other apps like Dave; personal loans, overdrafts, and credit card usage will be linked to the operating principles. The platform was launched in 2017, and now it has countless users taking financial assistance from the platform. If someone wants to continue working with Dave Inc. Services, they have to pay a $1 monthly subscription.

Dave is a personal finance app, which is renowned for “Extra Cash.” The application offers a short-term loan of up to $500. If your salary is not credited but there is an upcoming bill; then Dave can be your savior to withdraw extra cash when required. There is no interest or fees charged for using the application, but the users have to pay $1 for monthly membership. Dave provides great banking services to balance the requirements. The users of Dave can receive free ATM withdrawals at different 32000 locations.

Dave is best known for providing short-term loans, and the users do not need to pay less compared to other traditional payday lenders. Moreover, Dave demands from the borrowers to repay the loan amount on the next payday. If you need a loan for a long duration, then you better choose a traditional personal loan or a credit card.

Dave App is available to assist users in various ways; such as giving them cash advances, providing budgeting tools, management or finances, and more. Know how this application works:

Users can have little cash advance of $100 from the Dave app, which allows to cover unexpected costs on their next paycheck. To enable the process of money borrowing, the users have to enter his bank details and need to verify their income source.

The app has in-built feature, which enable to understand user’s investing and spending designs to predict when they will run low on funds. Even this feature sends notifications or alters to clients when they run low on funds, so that they can avoid overdraft expenses and other money-related issues.

Budgeting tool integrated in Dave app makes a difference among all apps existing in the marketplace. This tool will fix your budget, and also track their costs incurred categorized in transactions. Moreover, the integrated tool will also provide insights of user’s investing habits. The users can set their customized budget, which is divided in diverse categories; such as goods, entertainment, transportation, etc.

The users can prevent from extra expenses incurred, because the expense monitoring feature will tell them about where they are spending. Even this feature will intimidate them about how low they are running on their funds. It helps in avoiding overdraft expenses and other costs when the adjustments are getting low.

Dave provides a variety of banking services, such as a debit card, no-fee ATM transactions, and direct deposit. The Dave debit card can be used to make purchases, withdraw cash, and pay bills.

Ultimately the final goal of every app is to generate more profits. Taking advantage of users’ money is one different thing; on the contrary, lending them money and making profits through that are completely different concepts. Dave is the cash advance app; which does not charge for any fees or interest. Simultaneously, it has a certain business model, through which Dave runs its monetization process. Its agenda of Dave is to make customers feel the value of their money and emphasize serving their needs.

Dave follows certain monetization processes to make money; such as:

The primary source of income for Dave is its membership fee of $1 monthly. When Dave connects with another bank, they have to pay the cost of the application covered as membership fees. The application can cover expenditures without causing a burden to the customers.

Dave’s Mastercard Debit Card provides competitive interchange costs on the platform. If you are paying through a debit card, you will be charged with certain percentage of what you spent. The percentage will be less than 1%, therefore businesses are interested in opting for the same.

The main source of Dave’s income is donations. When the users borrow money, they have an option to leave some gratuity behind. Dave plants a tree for each tip they receive. Also, the users are not obligated to enter any tips throughout the application.

There is a function called “Side Hustle”, through which Dave earns a lot for the company. The partner of Dave who provides employment will pay the application a certain percentage also called referral fees whenever there is a need for a new worker through the app utilization.

The software lends money from the user’s account to other institutions like banks and professional organizations. Dave charges these institutions 3.35% interest on money lent, which is a valuable source of revenue for the app.

If anyone thinks of building such an app, they must have some clarifications about features to include in a cash advance app like Dave; such as:

Applying for a loan and receiving the needed amount is an easier task, in fact, this process will be really hectic and time-consuming. Therefore, the foremost step one should follow has to be signing up and registering for the application. It will take a few seconds to sign up in the app. Once the Lend Money app gets a request from users; the security measures will verify the user’s identity and his account to process further.

If the money lending or the cash advance app is unable to provide money instantly to the users, then what’s the point for consumers to use such apps? Therefore, during the development of money apps like Dave, provides money to the user’s account immediately or tells the location from where they can get money.

You can also add a repayment option, as you have your business in hand. In this feature, the loan amount will be directly deducted from the user’s account when their salary is credited. Even this feature enables customers to track their balances and loan amounts.

Do you want to know about the pending money expenses? Need the cash advance app to remind you of upcoming payments? If you want the mobile app to notify you about necessary user account and balance information; then the quick notifications feature will work for that. Even, this feature will also notify users in real time about spending more money when they should not do that.

In the fintech apps, the users can free/unfreeze their cards in case they lose their debit card. It states that the company takes care of the users in every situation and condition; so that they can access the services smoothly and conveniently. Additionally, the users can unfreeze their frozen card and reuse it.

No app development process should miss the feature called “Loan Calculator.” The calculator will sum up the amount (loan amount + interest amount), that the customer has to pay. Even, this feature will help the users to educate them about their loan and payable amount. So eliminates the time consumption of the loan calculating process, and makes things easier and quicker.

In the apps like Dave app, there is a feature called voluntary tipping. The money lending apps offer free-of-charge services and also $1 monthly membership fees; additionally, this tipping will encourage the users to tip for the services according to the user’s convenience.

If the users are spending more than they should, then credit score building functionality can handle such a situation. It allows the users to track their rent payments made to credit bureaus.

Adding up common or must-have features in your money apps like Dave is necessary. Simultaneously, you have to think about making the app unique, because there are already many competitors existing in the marketplace. So here are some extra unique and advanced features you can add in your application:

You can add the feature in cash advance app, which enable to let users understand where to invest and grow their wealth for long-term. The application will provide educational guides and investment recommendations; which helps the users to know what, how and when to invest. These advices and suggestions given by the app are based on user’s financial goals and final objectives without risks.

Additionally, the clients can decide to offer investment platform where the users can put their savings as an investment; such as bonds, stocks, mutual funds, etc.

Integrating artificial intelligence-powered financial advisor into the app will help users to get personlized recommendations using machine learning algorithms. This will help in knowing and maintaining financial goals and spending habits. With the help of this feature, users can gather enough information and take right decisions about the finances, and also managing their budget to pay off.

Users can donate a portion of their loan or savings to a charity or cause of their choice through charitable giving. This tool enables users to give back and make a difference while perhaps obtaining a tax benefit. The app might collaborate with numerous charities and causes to present users with a variety of contributing alternatives.

A group loan is a feature that allows friends or family to pool their resources and help each other out when they are in financial need. This feature is especially useful for people who do not have a strong credit score or are unable to obtain traditional sources of credit. Users can form groups and invite their friends and family to join. When one of the group members files for a loan, the entire group is responsible for repaying it.

Social Impact Loans are options, in which the users can invest loan amount in small businesses in undeserved communities. This won’t only provide financial assistance, but also it enables positive social impact. It allow the users to make difference in the communities, and also support the small businesses to grow. There are various investment opportunities available in the application, which the users can choose to put their savings. But this feature is not the basic one, so make sure the developers are asked to integrate that.

Do you want to develop money apps like Dave? If so, that’s completely fine and read to know the important things to keep in mind during the development process:

When the user needs money to pay his upcoming bills in 1-2 days but his salary takes time to credit more 5-10 days, then users need money to lend immediately. Therefore, the cash advance apps should instantly lend money to the user in real-time to fulfill their needs. This is what makes your application much more effective for the users.

Whenever someone lends money through a person or an application, the users are concerned about interests and other hidden charges. Make sure when you develop cash advance apps that; don’t charge hidden costs from the user. This is what helps to retain the users because they will get services and be able to lend money with no further extra cost.

The money lending apps or cash advance apps should collaborate and work with as many banks as possible. You might have gone through multiple apps like Dave to understand the concept, where Even Cash Advance app has collaborated with 18000 bigger and smaller banks. Moreover, cash apps like Moneylion have also collaborated with thousands of banks.

Here is a brief we are providing about, “how to build a money app like Dave?” Read and understand the process of development:

At first you must evaluate your own vision and understand what you want to build. Once you are aware of your own ideologies, then continue with the market research and targeted audience. It is important to do deep and vast market research to know what is going on and how other competitors are ranking in the marketplace. Also, understand your own targeted audience to plan things accordingly and hit them for more reach.

To develop money apps like Dave, it is very important to shortlist the tech stacks for its agile development. Even more, there are many emerging technologies that can be selected by the clients and developers to build their apps appropriately.

When it comes to the app’s design, the mobile app development company in India will work on the designs. Also, the developers can suggest and execute the latest tech trends in apps with designs to make it a more seamless user experience and smooth interface.

It is a very important stage, where the mobile app developers will write the codes, add the features, integrate the latest technologies integration, and more. No chances of bugs and technical glitches happening here, because the developers will completely give structure and navigation to the application.

Now the developed cash advance apps are required to launch in the marketplace. Clients have already told you about the respective platform to launch the application.

Once the mobile application cash advance app is launched, then it requires support and maintenance after deployment. In the support and maintenance stage, the mobile app developers will debug your application and also remove all the technical glitches making the app run smoothly in the marketplace.

Whether you are building a money app like Dave for iOS or Android; there are some tech-stacks to include; such as:

| Base-Technologies (Android & iOS) | Kotlin & Swift |

| Back-End | Python, C++, Java, Laravel, and PHP |

| Front-End | Laravel Nova, JavaScript, React, Angular, TypeScript |

| Databases | Oracle and DB2, MongoDB, AWS, Oracle |

| Others | Google SDK, Twilio, Firebase, RESTFUL API, Twilio, Facebook SDK |

| Mobile Payment App Integration | Google Pay, Apple Pay, Garmin Pay, Samsung Pay, Venmo, PayPal |

| Real-Time Analytics | BigData, Cisco, IBM |

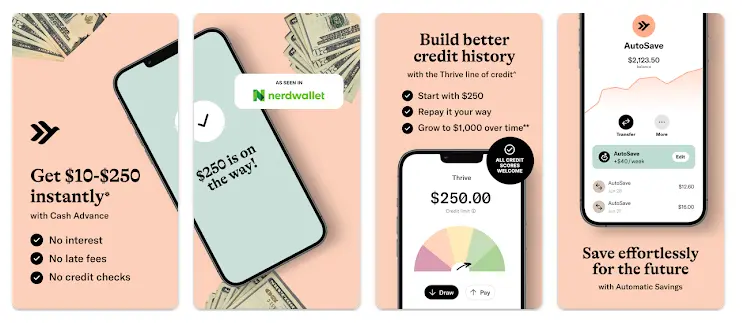

No doubt that, Dave is the one money app which is very popular among all. Simultaneously there are some alternative apps like Dave we are talking about, which people can use instead of this app. So here we carry forward the discussion:

The Empower App lets users lend up to $250 cash advances. There are no interests, fees, or credit checks applied. The eligibility will take place in the earned income account and other account activity to know how much the users can borrow. This application will provide a two-day early paycheck scheme to the users.

The users are required to activate the Empower Card to receive the cash advances. Yet users have to pay $8 as a monthly subscription, but this membership will come with many extra benefits; like cash-back rewards and free-ATM withdrawals as well.

Pros

Cons

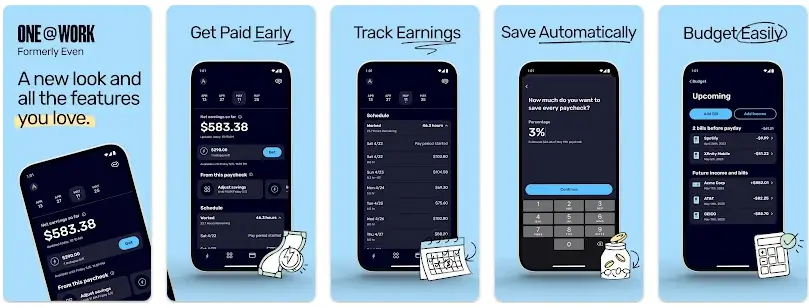

It is another app like Dave, which is popular for providing on-demand money to borrowers who are in need. Even the application, which has incorporated or partnered with thousands and more employers to lend money. Although the app will not charge any interest fees; still it charges an $8 membership fee only. It also helps the users in budgeting from paychecks to the paychecks; and shares notifications for upcoming bills, and also how much you need for them.

You must know that, the employer is only available with selected players with whom the partners have partnered with the application. Moreover, this application is working with 18,000+ banks for its InstaPay feature; which enables to deposit of a certain amount into the user’s accounts. Even Cash Advance Apps does not disburse loans just like other apps.

Pros

Cons

$8 monthly membership fees

Apps like MoneyLion is a kinda of all-in-one mobile banking app; in which the users can borrow, invest, save, and earn money easily and quicker. It provides early paychecks and easy cash advances to the users in real-time with its ultimate “Instamart Feature.” It allows the users to borrow up to $250 of their next paycheck without any interest and without a credit check. The company allows users to receive money immediately, irrespective of any time of the day.

There is one feature named “RoarMoney”, which gives access to the paychecks even two days earlier. Moneylion apps are very popular in the marketplace because there is no minimum balance requirement. There are no such fees charged by the company for standard transfers, mobile check deposits, foreign transactions, and card replacements.

Pros

Cons

This cash advance app is more expensive, which costs $20 monthly membership subscription.

If you want to build an app like Dave, the average cost to build a cash advance app is $30000. This cost estimation of development will increase when the clients demand more features, the latest technologies integration, AI Tech add-ons, and more. This cost can rise up to $60000 and even more, depending upon various factors; such as

Apart from the estimated cost, you must know different factors affect the cost of Dave Like app Development; such as:

Cost of Development Team

The cost of cash advance app development depends when the development team size increases. If you hire more developers and highly skilled ones; then this will automatically impact and increase the cost of development.

Project Complexity

As the complexity of the app increases; by the very same time the mobile app development cost will also increase. So the features, design, architecture, and concept of an application like Dave will get complex; it will affect the development cost.

User Experience

A well-designed and great UI/UX will increase the engagement and retention of users. That is why, if you hire some experienced and talented designers; that might cost much than expected.

Deployment Strategy

Deployment platforms really affect the cost of development apps like Dave. If you choose Android; that will cost differently. Apart from this; the iPhone app development companies will charge differ for iOS apps. In case you choose to deploy at both platforms will change and increase the cost.

Backend Infrastructure

The API that communicates data between the app and the database can have an impact on the price.

After reading things about Cash Advance Apps; are you thinking about cash advance app development? If it is a yes, then Konstant InfoSolutions is best app development company in India to consult and develop a prominent solution. If you want to create good experience in the financial industry, then developing cash advance apps like Dave will be a great idea for growth. Our experts will provide guidance and support to clients for stepping into business. Consult with talented and skilled mobile app developers about fintech app ideas, and they will suggest you with some best solutions & practices following for your business growth.

The ideas of Fintech Apps is growing at vastest scale in the marketplace. Nowadays, taking short-term loan through the finance apps is very common and normal. Therefore, developing such apps are very great in growing your businesses. Building an app like Dave needs clear understandings and clarifications, and this blog has mentioned every possible thing. Still there is any doubt striking in head, you can consult with the mobile app fintech developers in Konstant Infosolutions. The experts will definitely guide you, and share important information regarding financial management.

Building a mobile app is definitely a time taking process; which includes various stages. The mobile app development will take an average of 3 months, and also this time duration might carry forward if the features and tech-stacks are involved with more complexity.

There are many features includes in Cash Advance Apps; which are highlighted right below:

Yes, the app development company will provide support & maintenance after deployment. The developers will remove all the technical glitches, resolve issues, debug the application, and make it work seamlessly in the marketplace.

Vipin Jain is the Co-Founder and CEO at Konstant Infosolutions and is in charge of marketing, project management, administration and R&D at the company. With his marketing background, Vipin Jain has developed and honed the company’s vision, corporate structure & initiatives and its goals, and brought the company into the current era of success.

Or send us an email at: [email protected]